Investors and analysts are intently examining this week's Federal Reserve meeting for clues about the central bank's forthcoming actions. While the Fed held interest rates frozen, its statement hinted at a potential shift in approach in the quarters ahead.

- Key among the insights was the Fed's admission of lingering inflation pressures, suggesting that further tightening to monetary approach could be on the agenda.

- Furthermore, the Fed signaled its dedication to returning inflation to its target of 2%, underscoring that price stability remains a top priority.

- Finally, the Fed's outlook for economic development appeared {cautiously optimistic|, suggesting a period of steady progress in the coming year.

However, investors should stay aware as economic conditions can evolve rapidly, and the Fed's next moves will be heavily influenced by incoming indicators.

Rate Hike

The Federal Reserve's next meeting is looming, and investors are anxiously awaiting its decision on monetary policy. Will the Fed continue to raise interest rates? Current inflation suggest a range of possibilities, making it difficult to predict. Some analysts believe another rate could be on the table, citing tight labor market as justification. Others argue that the Fed may opt for a data-dependent approach in light of recent declining business investment. Ultimately, the Fed's decision will have significant implications for borrowing costs, investment decisions, and the overall economy.

- Key factors to consider include:inflation, economic growth, labor market conditions, and global events

- Keep an eye on speeches from Fed officials in the lead-up to the meeting for clues about their thinking

- Market reaction to the decision will provide insight into investors' expectations for the future of monetary policy

Will Inflation Finally Ease? Investors Watch for Clues at Fed Meeting

Investors watch closely awaiting clues on the future of inflation as the Federal Reserve convenes this week. Recent data has indicated a potential cooling in price increases, sparking hope that the Fed may adjust its aggressive monetary policy stance. A change in interest rates is still widely anticipated, but the size of any increase will be a key focus for markets. Experts will examine the Fed's statement for hints about its view on inflation and the potential for further adjustments in the coming months.

The Federal Reserve's Outlook on Growth and Unemployment in Focus

Investors are eagerly anticipating the Federal Reserve's latest economic projections. The meeting, scheduled for latenext week, shed light on the Fed's assessment of current economic conditions and its influence over both growth and unemployment.

The central bank has been carefully monitoring signs of inflation and may provide guidance on its plan regarding interest rates in the coming months. There is a spectrum of opinion on whether the Fed will increase interest rates again at this meeting, with some First-time home seller tips Miami pointing to strong economic data, while others warn of the potential for a recession. The Fed's statements will be closely watched by markets as investors try and understand the future path of monetary policy.

Markets Brace for Impact: Analyzing the Fed's Forward Guidance

Financial markets are on high alert as investors analyze the latest pronouncements from the Federal Reserve.

The Fed's projections on future interest rate hikes and monetary policy have grown into a key factor of market sentiment. Economists are carefully parsing the subtleties within the Fed's speech for clues on the path of the economy and its potential consequences on asset prices.

Volatility remains high as traders adjust to the evolving macroeconomic landscape. The Fed's stance on inflation, accompanied by global economic headwinds, has created a challenging environment for investors.

Unveiling the Fed's Strategy: A Deep Dive into This Week's Communication exploring

The Federal Reserve's recent meeting generated significant interest, with market participants eagerly decoding its communication for clues about future monetary policy. This week's statement and press conference provided a abundance of data regarding the Fed's current outlook on the economy, inflation, and its stance towards interest rates.

A key focus of the communication was the Fed's commitment to controlling inflation, which remains elevated above its objective. The statement emphasized the central bank's willingness to deploy further tools if necessary to achieve price equilibrium.

Moreover, the Fed presented a nuanced analysis of current economic conditions, acknowledging both gains and challenges. Representatives emphasized the importance of tracking key economic indicators closely to inform future policy decisions.

Daniel Stern Then & Now!

Daniel Stern Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Jennifer Love Hewitt Then & Now!

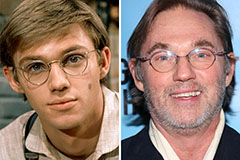

Jennifer Love Hewitt Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now!